Invest Gains Capital — Where Finance, Strategy, and Power Converge

At Invest Gains Capital, we build the financial engines that nations use to rise.

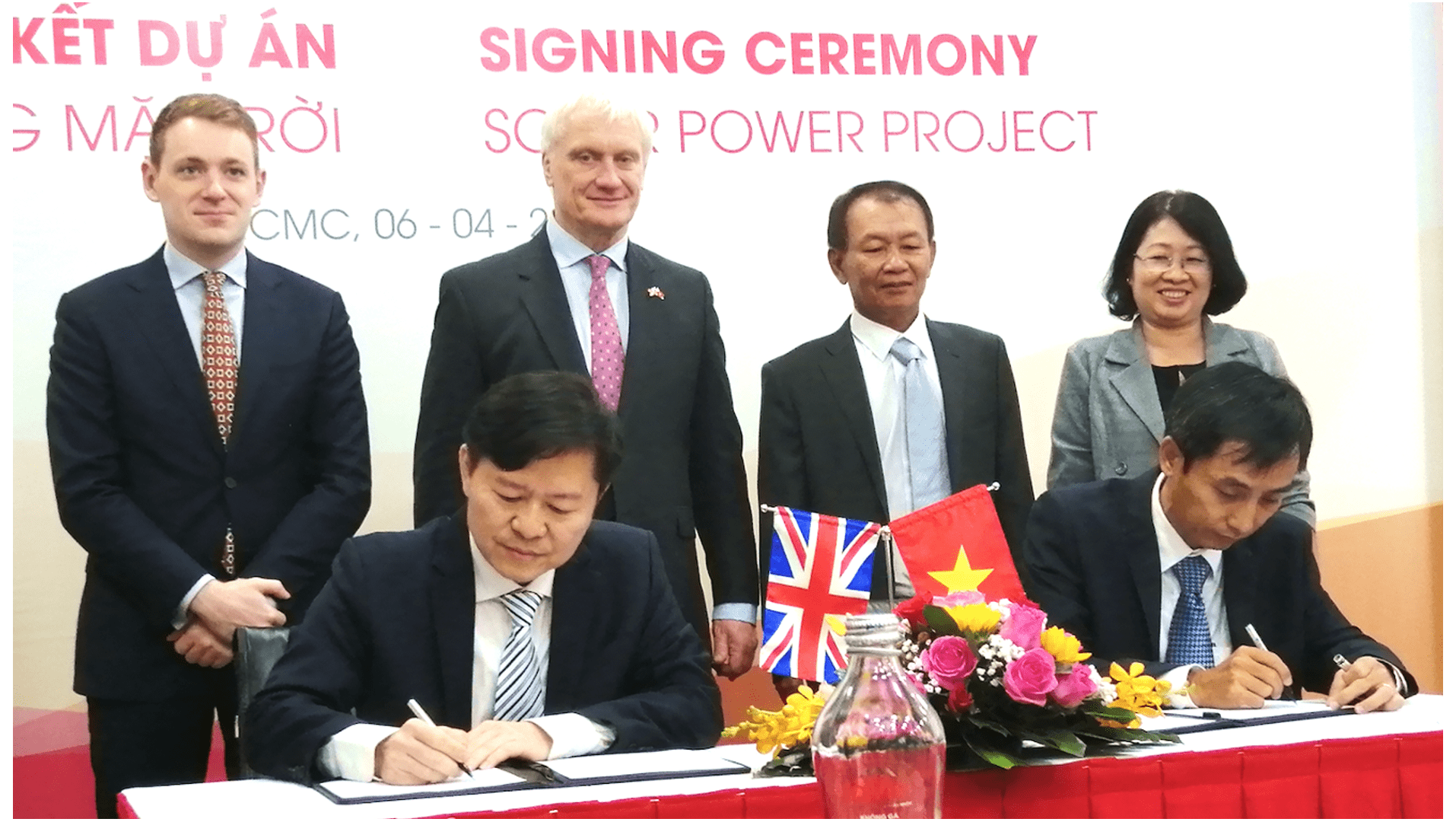

We mobilise capital through traditional markets and next-generation digital bonds, working directly with governments, DFIs, institutions, and industry leaders. Our work turns policies into pipelines, projects into bankable assets, and influence into economic outcomes.

But we do more than raise funds.

We create opportunity — shaping perception, strengthening institutional capability, and structuring deals that shift national trajectories. Our model unites financial innovation, strategic branding, and high-level advisory to deliver long-term, scalable development outcomes.

Our Mission

Harness emerging financial technologies for infrastructure funding

Educate and advise project leaders on best-in-class finance strategies

Build and elevate brand equity to attract strategic partners and investors

Recognised as a finalist for the Mayor of London Lewisham Business Awards 2023 – Best Sustainability Business, we bring both credibility and cutting-edge solutions to complex capital challenges.

Our Model: Connect Capital → Shape Perception → Build Structures

1. Connect Capital

We mobilise funding across banks, DFIs, private equity, sovereign partners, and digital bond markets.

We unlock financing for infrastructure, energy, and national development.

2. Shape Perception

We build credibility through targeted media, strategic narratives, and stakeholder engagement.

We turn visibility into investor confidence.

3. Build Structures

We design financial frameworks, blended-finance models, and digital bond architectures that endure.

We create the systems that allow nations to grow with stability and transparency.

This is how we transform capital access for emerging markets.

Our Expertise

1. Digital Bonds — Next-Generation Infrastructure Finance

Blockchain-enabled Digital Bonds reducing issuance costs and increasing transparency

Faster settlement, real-time impact reporting, and wider investor participation

Ideal for large-scale projects seeking innovative capital market solutions with strong ESG accountability

2. Financing Advisory & Education

Advisory for governments, DFIs, and project owners on structuring sustainable finance

Training on digital bond issuance, credit enhancements, and green finance compliance

Building institutional capability to access global capital confidently and transparently

3. Brand Equity for Infrastructure Leaders

Elevate project visibility with strategic media and storytelling

Strengthen credibility with investors through transparent impact communication

Position projects as leaders in innovation and sustainability — attracting top-tier financing partners

Who We Serve

National & regional governments accelerating infrastructure delivery

Development Finance Institutions advancing climate-aligned investments

Large-scale project owners requiring innovative, transparent financing models

Recent Achievements & Milestones

Finalist – Best Sustainability Business, Lewisham Business Awards 2023

5 MW of renewable energy projects completed through strategic advisory

Trusted by organisations across media, finance, and sustainability for high-impact advisory and visibility support

We don’t chase opportunities — we build the systems that create them.